The Future of Food: Cloud Kitchens ☁️

The Food Delivery Boom 🥡

While the Pandemic shuttered thousands of businesses, it’s been a huge catalyst for change in the food industry with delivery apps being the biggest winners:

Of all Delivery Apps, Uber is the most diversified

In the words of Dara Khosrowshahi (CEO of Uber)… "We have a hugely valuable hedge across our two core businesses. When travel restrictions lift we know the mobility trips rebound. If restrictions continue our delivery business will compensate."

For a more clear view, let’s look at the changing composition of their Gross Bookings:

Pre-Pandemic (Q1’20) = 30% Food Delivery + 70% Ride Sharing

Pandemic (Q1’21) = 65% Food Delivery + 35% Ride Sharing

To understand how crucial delivery bookings are to the future of Uber, we need only look at their actions over the past year:

Acquisitions:

Uber buys Postmates for $2.65B (becomes 2nd largest food delivery provider)

Uber expands into Alcohol Delivery (via acquisition of Drizly for $1.1B)

Partnerships:

Uber expands into Grocery Delivery with Albertsons partnership (1,200 Stores)

To deliver Everyday Essentials, they partnered with Gopuff (650 Cities)

To offer Prescription Delivery, they partnered with Nimble (available in NYC)

The Restaurant Reality 🌮

The pandemic hasn’t been kind to restaurants.

In 2020, the US saw 110,000 restaurants close and sales fall by $240B. Those who did survive, found salvation in delivery apps… but the economics just don’t work:

Avg. restaurant profit margins = 3-5%.

Delivery = Reduction of high margin items sold (ex. restaurants often mark up beer by 5-6x, but no one orders drinks for food delivery)

App fees = More margin erosion

Cloud Kitchens ☁️👩🍳

Since his departure from Uber, Travis Kalanick has reportedly raised $400m from Saudi Arabia’s Public Investment Fund to fuel his next venture: Cloud Kitchens.

And its not just Uber… DoorDash isn’t launching Cloud Kitchens rapidly too.

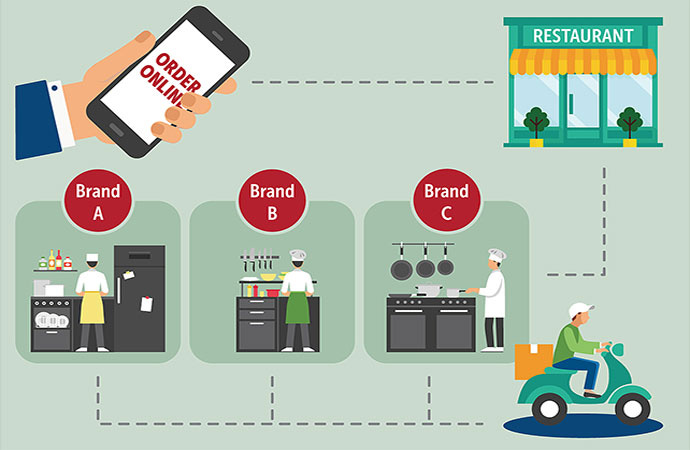

What is a Cloud Kitchen?

It’s a commercial kitchen with a virtual store front, that resides within a delivery app. It offers food delivery only, and can churn out food for multiple brands and cuisines.

It’s designed for food delivery:

Scalable (it’s commercial kitchens can expand based on demand)

Higher margins (due to less traditional expenses and cheaper real estate)

Data Driven (easily change menus based on customer data / trends)

Seamless (manage all your deliver orders through a single workflow)

Traditional Restaurants don’t stand a chance:

Since it’s a white label kitchen, they can be more resilient. Bad reviews today? No problem, simply relaunch with another restaurant name tomorrow.

It’s the wild west - a virtual kitchen in San Francisco impersonated a Michelin star restaurant and cannibalized sales for weeks.

They have rich investor backing, and pricing power - meaning they can drop prices and lose money on orders longer than traditional restaurants.

The pandemic already has the restaurant industry on the ropes, making this an opportune time for Cloud Kitchens to gain market share.

The End State:

A polarization of food is unavoidable. Cloud Kitchens will dominate food delivery, and in-person restaurants will need to shine based on a unique dining experience… those in the middle will get squeezed out.